Essential 2025 State E-File Deadlines Simplified

Jan 8th 2026

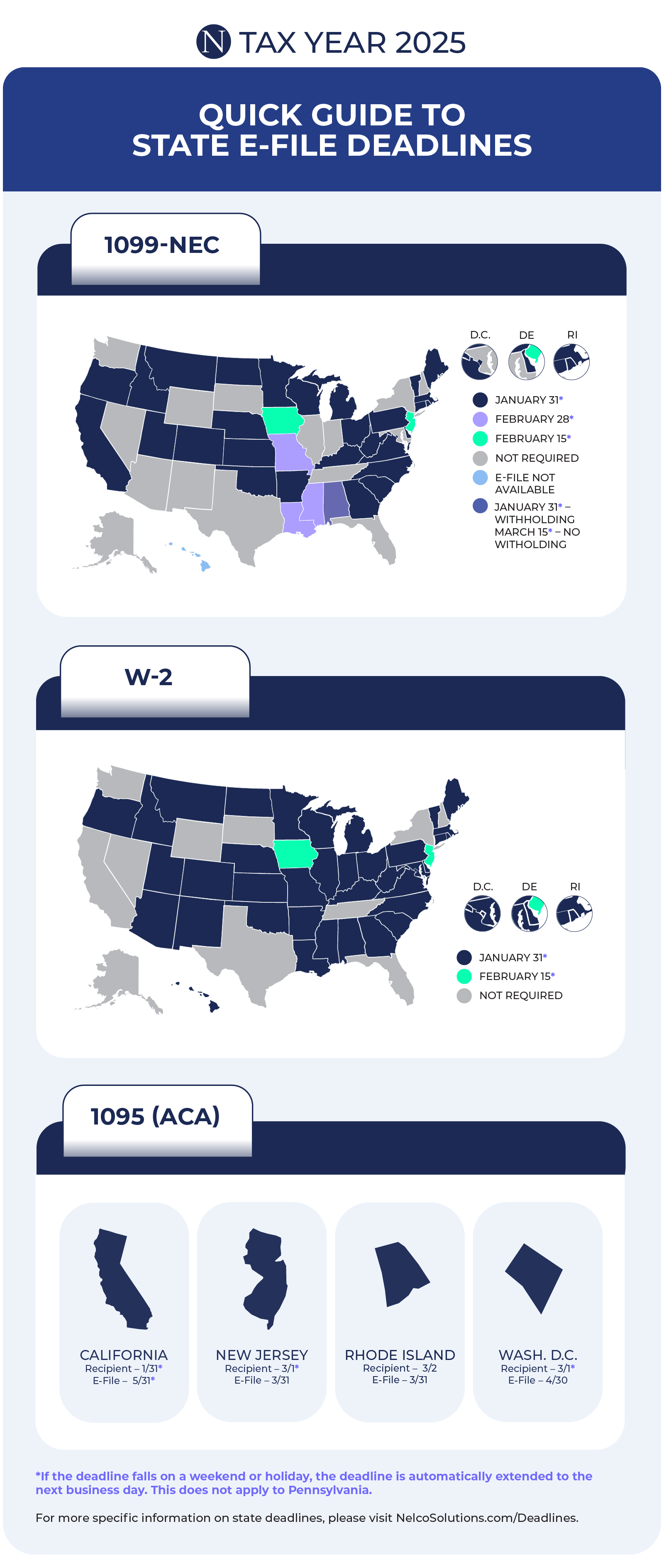

We are in the thick of tax season, don’t let varying state deadlines catch you off guard. While federal and recipient electronic filing deadlines are consistent, state W-2, 1099, and 1095 deadlines vary.

Notice: Many state, federal and recipient e-file deadlines fall on February 2, 2026, due to January 31 falling on a weekend. Below are some steps to help you meet your filing requirements:

Quick Steps to Stay Compliant:

- Confirm State Requirements

Deadlines differ by state. Check where your business, employees, or contractors operate.

- Plan Ahead

Starting early reduces stress and prevents costly mistakes.

- File with Integrated E-File Tools

Your software program may offer an all-inclusive e-file tool that streamlines federal, state, and recipient filing. Integrated e-file tools simplify compliance by providing seamless data transfer, error detection, and fast status updates. Some companies such as Nelco also can handle the printing, mailing, and electronic delivery of recipient copies for you alongside their federal and state filing services.

Explore state-specific e-file deadlines for 1099-NEC, W-2, and ACA forms below:

Other Important Deadlines for 1099-NEC & W-2 Forms:

Federal Deadline (E-File & Paper): February 2, 2026

Recipient Deadline: February 2, 2026

For more form types or deadlines, visit Nelco’s deadline calculator.