Key 2025 Tax Deadlines Businesses Must Meet

Jan 2nd 2026

As the new year begins, businesses face critical responsibilities to ensure compliance with federal and state reporting requirements. Filing W-2, 1099, and 1095 forms on time is not just a regulatory obligation, but a safeguard against costly penalties and unnecessary stress.

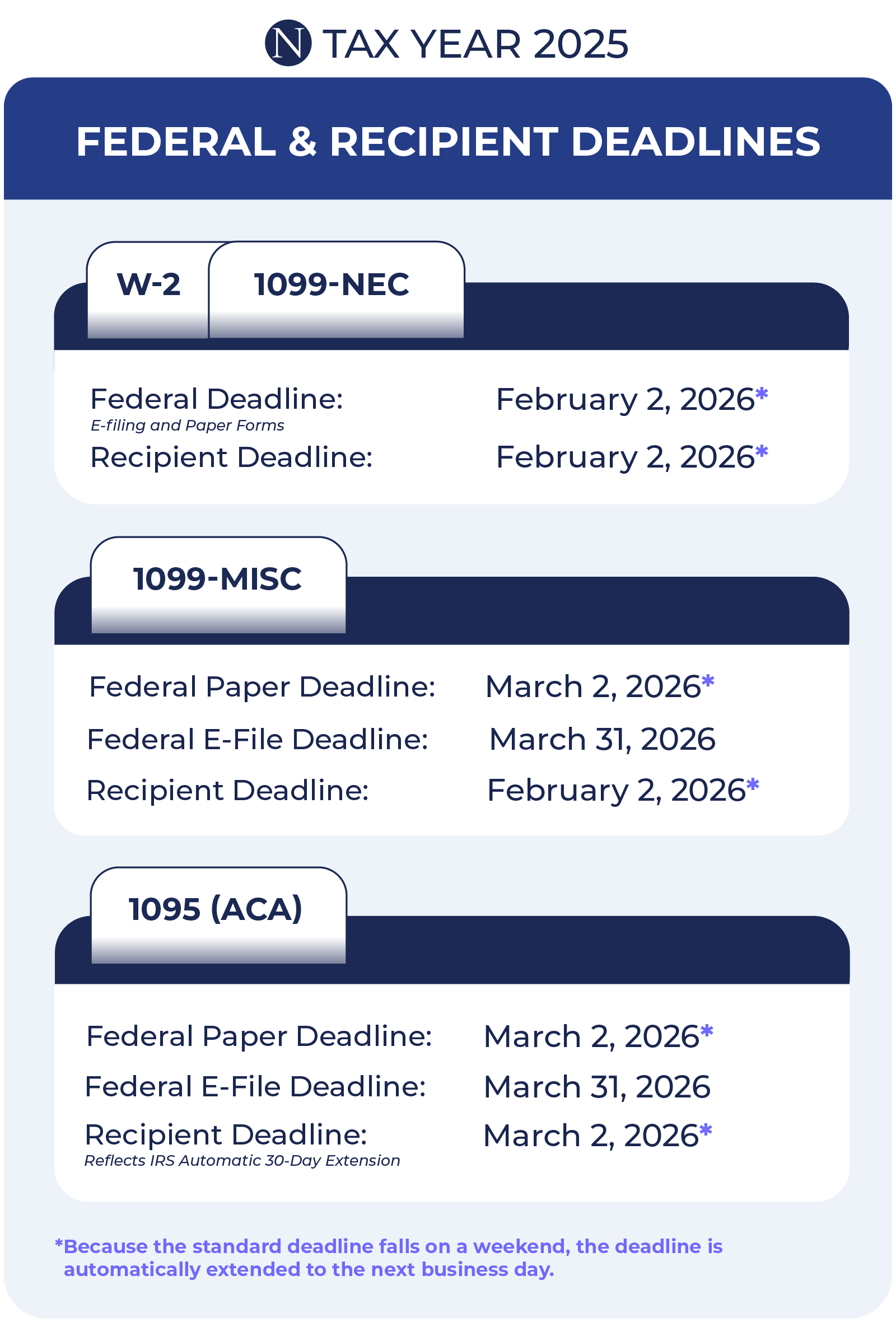

For tax year 2025, it is important to note the filing deadlines. W-2 and 1099-NEC forms must be submitted to both recipients and the IRS or SSA by February 2, 2026. This change from the typical January 31 deadline occurs because January 31 falls on a weekend, resulting in the due date moving to the next business day. Businesses should plan accordingly to ensure all forms are prepared and filed on time.

For 1099-MISC forms, recipient copies are also due February 2, while paper filings to the IRS must be completed and post marked by March 2 (due to February 28 falling on a weekend), and electronic filings by March 31. Similarly, 1095 forms must be provided to recipients by March 2, with IRS submissions due March 2 for paper (due to February 28 falling on a weekend) and March 31 for e-file.

The importance of meeting these deadlines cannot be overstated. Late or inaccurate filings can lead to compliance issues and financial penalties, which can quickly escalate for businesses managing multiple forms. Starting early and using reliable tools helps reduce risk and ensures accuracy, giving organizations peace of mind during a busy season.

To make this process easier, some businesses may be able to take advantage of a complete and seamless electronic filing tool available through their software. This type of integrated e-file service streamlines data transfer to the IRS, SSA, and recipients, ensuring easy, timely and accurate submissions.

Many software companies partner with industry leaders like Nelco, who specialize in W-2, 1099, and 1095 forms and solutions, to provide the expertise and technology that help make filing less stressful and more manageable for your organization. By leveraging an all-inclusive e-file tool (check with your software provider for availability), businesses can minimize compliance risks and simplify year-end reporting, transforming what is often a stressful task into a smooth, efficient process.

For more form types or state deadlines, view Nelco's deadline calculator >