Quick Guide to 2024 State E-File Deadlines

Jan 14th 2025

As the tax deadlines approach, it's important for businesses to track key state e-file deadlines for W-2, 1099, and 1095 forms. While federal deadlines are consistent, state deadlines vary, requiring businesses to stay organized to avoid penalties.

3 Tips for Staying on Track:

- Check State Deadlines: Verify W-2, 1099, and 1095 deadlines and requirements for the states where your business, employees, or contractors operate.

- Use Complete E-File Tools: An all-inclusive e-filing program may be available through your software. Tools like this will simplify submission to federal and state agencies, as well as recipient delivery. Companies, like Nelco, provide print and mail recipient delivery service with their filing tool through software partnerships. They handle the printing, mailing and electronic delivery of recipient copies for you.

- Start Early: Early preparation prevents last-minute issues and errors.

State e-file deadlines for W-2, 1099, and 1095 forms can differ from federal deadlines. Staying informed and using an all-inclusive electronic filing tool can help your business meet deadlines and avoid penalties.

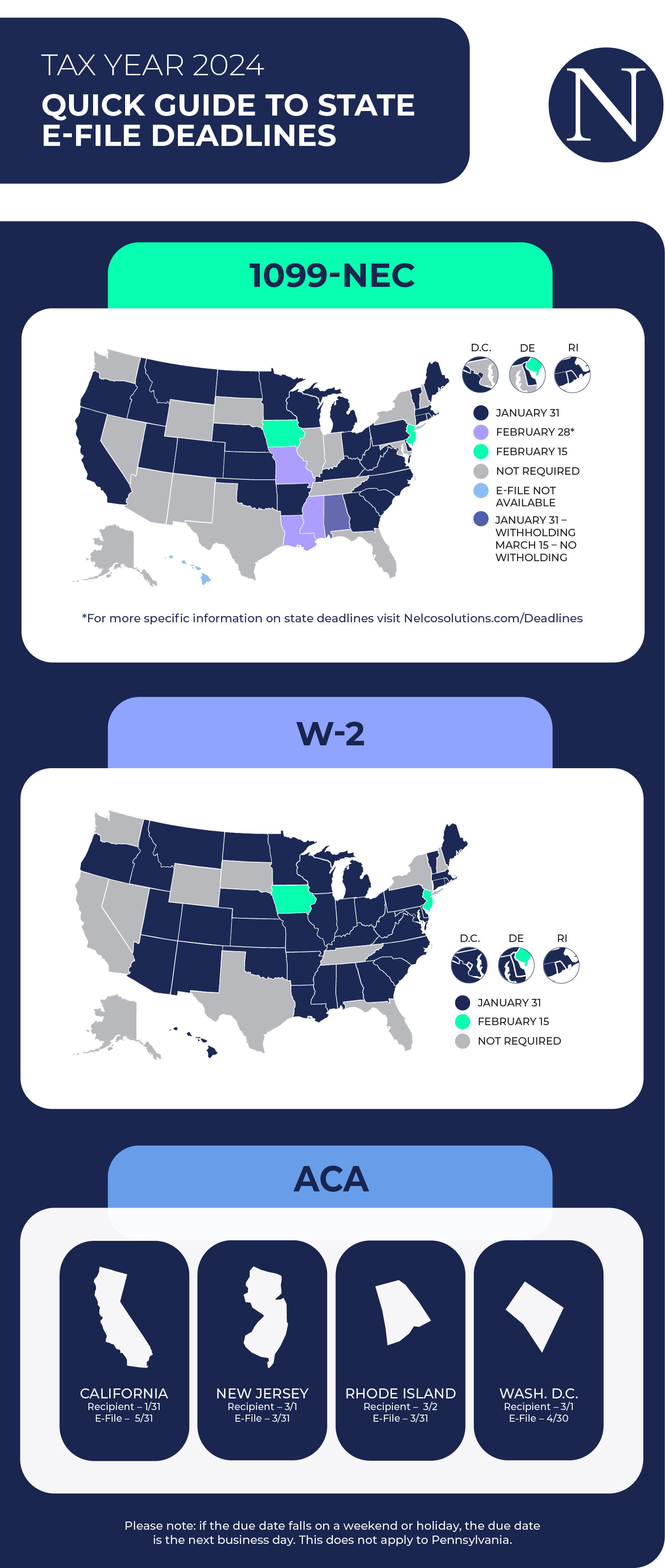

Check out 1099-NEC, W-2, and ACA state e-file deadlines for tax year 2024.

For more form types or deadlines, visit Nelco’s deadline calculator.

Other Important Deadlines for 1099-NEC & W-2 Forms:

Federal Deadline (E-File & Paper): January 31, 2025

Recipient Deadline: January 31, 2025