2023 State E-File Deadlines at a Glance

Jan 15th 2024

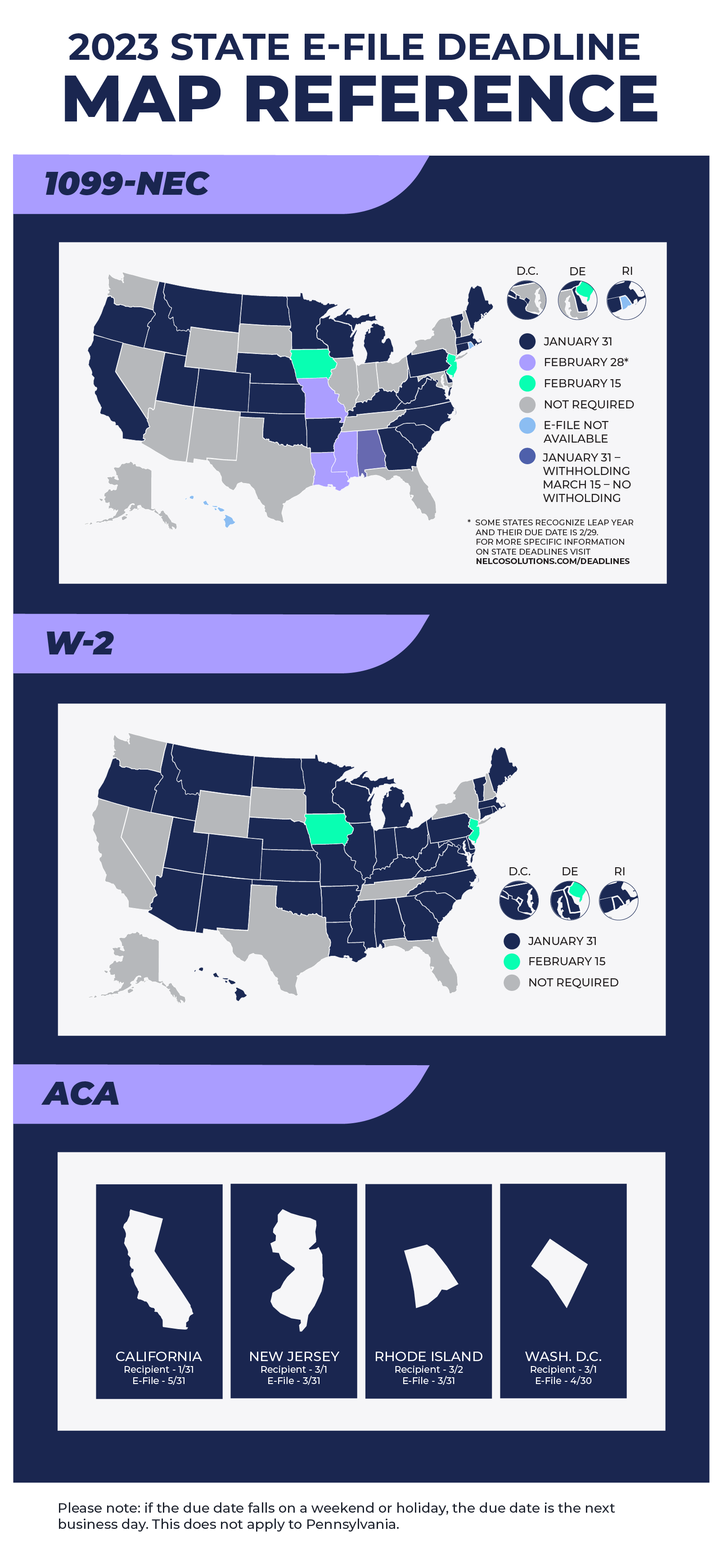

It may be hard to keep up with what is required of your business this tax season, especially with the IRS reducing the e-file threshold for some of the most popular form types. With this impacting most businesses, states may be following suit and changing deadlines to match the federal government.

Quickly identify the 1099-NEC, W-2, and ACA state e-file deadlines for tax year 2023.

It is important to know the state-specific requirements for either the state where you do business, or the state where your employee or contract worker lives.

For more form types or deadlines, visit Nelco’s deadline calculator.

Nelco offers filing solutions and expert service to help make the complex process of W-2, 1099 and 1095 filing easier for businesses. Nelco’s complete electronic filing solution allows businesses to file with ease through their software to the federal government, state(s), and recipients. Nelco can even handle the printing, mailing, and electronic delivery of recipient copies for you. Meet all your filing requirements in a few clicks through the software your company already uses.

Other Important Deadlines for 1099-NEC & W-2 Forms:

Federal Deadline (E-File & Paper): January 31, 2024

Recipient Deadline: January 31, 2024