Business Filing Deadlines: Tax Year 2023

Dec 13th 2023

With the expansion of the electronic filing mandate for tax year 2023, businesses will need to be more aware of the varying requirements and deadlines between year-end form types and filing methods. Electronic filing will become the popular filing method this tax season, due to many businesses meeting the new IRS requirements along with the aggregate rule. Paper filing is still an option for some companies that fall under the filing threshold and allowed form types.

Knowing filing deadlines and filing accurately is important. Preparing now will help you make the best decisions, keep your stress levels low, and help your business avoid steep fines.

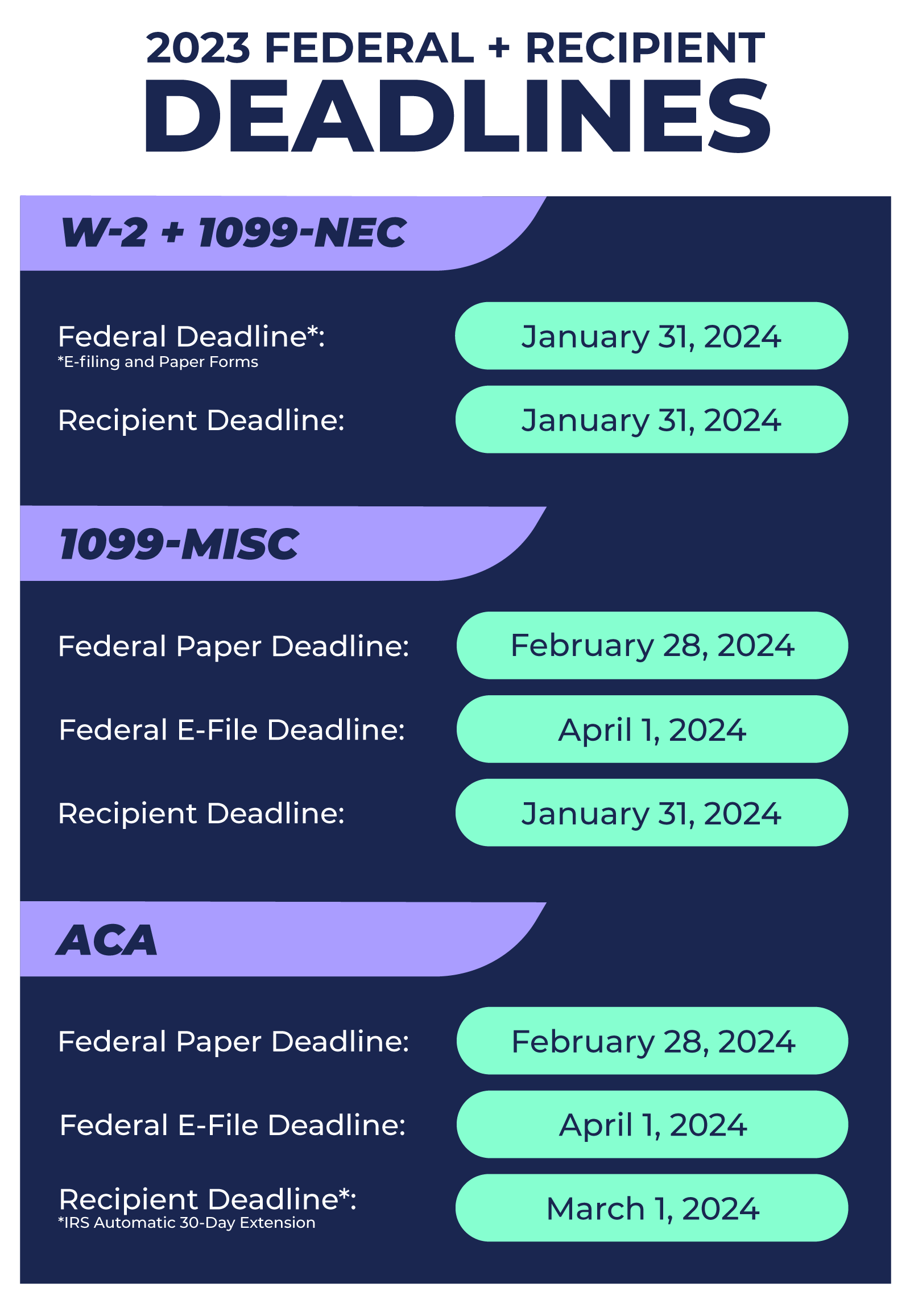

1099-NEC, 1099-MISC, W-2 & 1095-C are the most popular forms businesses file. Below are important filing deadlines businesses should know for Tax Year 2023.

If you need guidance, working with Nelco (a filing expert) will help you file with ease. For more form types or state deadlines, view Nelco's deadline calculator >

Nelco is a leader in wage and information reporting products and technology. Offering W-2, 1099 & 1095 filing solutions through your software. To learn more about the new e-file threshold requirements, please visit here.