Business Tax Filing Deadlines Are Coming. Are You Ready?

Nov 10th 2020

For many businesses, working from home has changed the way you do your job, but it shouldn't be the cause for postponing your year-end filing. Meeting filing deadlines for W-2, 1099 and 1095 forms is crucial for your business. If the federal or recipient deadlines are not met, you can potentially face large fines.

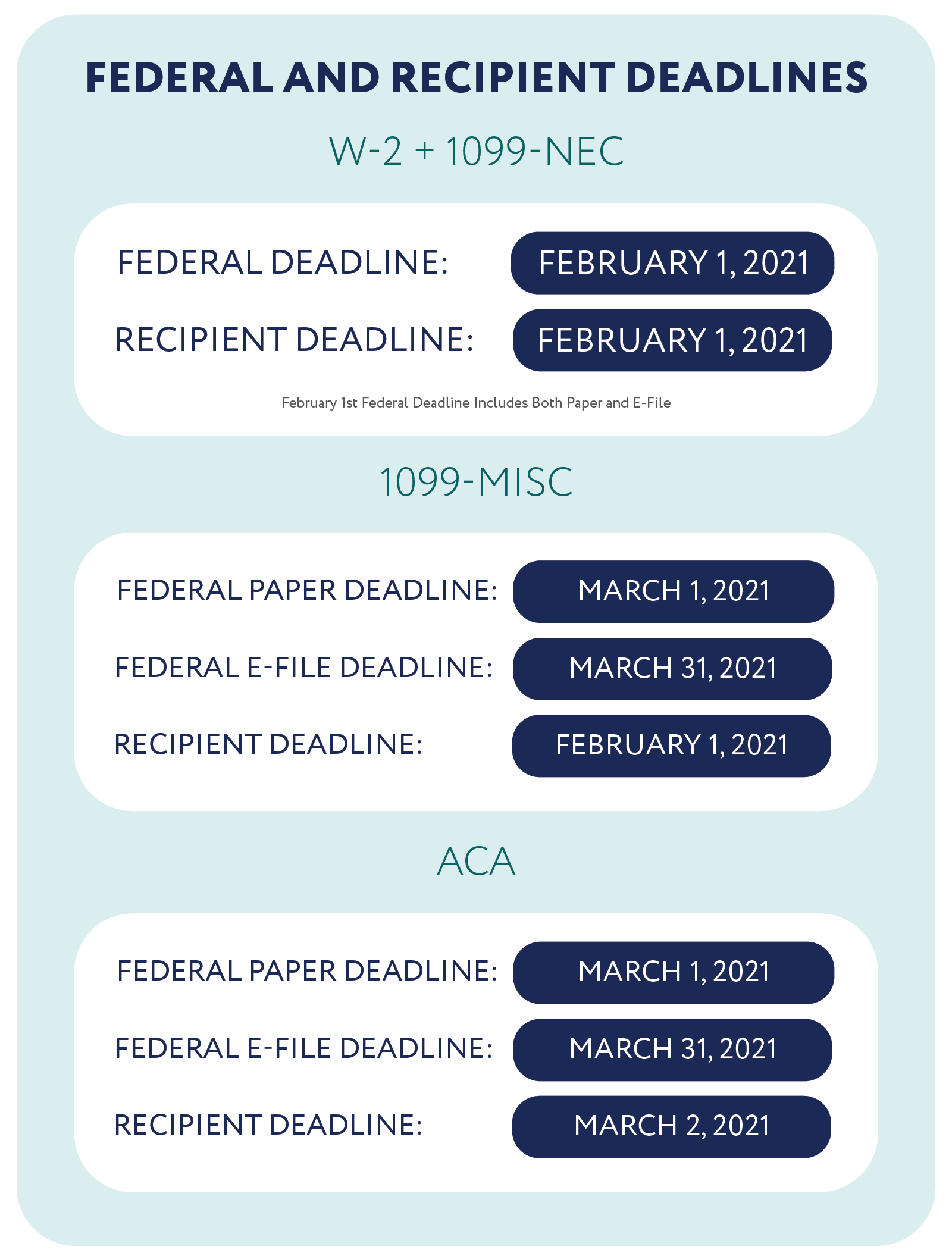

Below are the federal and recipient deadlines for three important forms your business may need to file, as well as the new Form 1099-NEC. This new form will be replacing nonemployee compensation reporting, typically reported on 1099-MISC (Box 7). Learn more about 1099-NEC from Nelco, the wage and information reporting experts: Nelcosolutions.com/1099-NEC.

Nelco offers year-end filing technology and products that are compatible with a large variety of software companies, to help make filing convenient and fast. Nelco also offers options for state reporting. To see more form types and state deadlines, visit Nelco's deadline calculator.