Steep Fines Persist. 2022 IRS & SSA Filing Penalties.

Jan 11th 2023

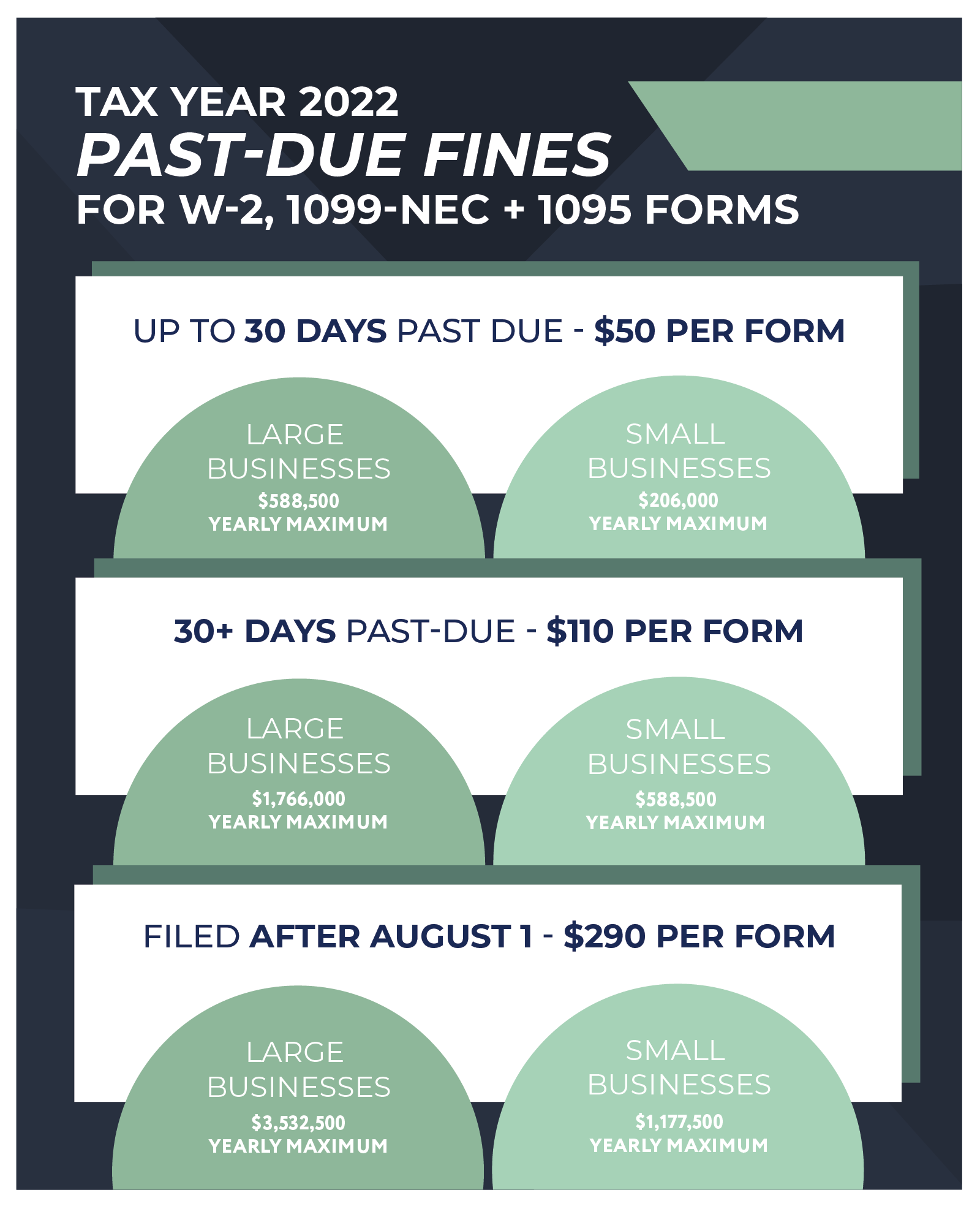

Failing to file W-2, 1099 or 1095 forms or missing deadlines may put your business at risk for large fines. Past due fines have continued to increase over the past few years, so preparing now is important. See the fines for tax year 2022 below.

The January 31st reporting deadline is right around the corner. To make filling easy on you and your business find a filing expert, like Nelco. In addition to offering completely paperless solutions and software compatible forms, Nelco’s team of experts is dedicated to helping businesses through reporting complexities.

Deadlines and requirements vary by state. For more deadlines and form information, view Nelco's deadline calculator.